2019 benchmark report: brand vs. non-brand traffic in Google Shopping

New research suggests that splitting campaigns to bid separately for branded traffic is worthwhile in many industries.

Sponsored Content: Smarter Ecommerce (smec) on December 12, 2019 at 7:30 am

- More

For paid search managers, developing an effective branded keyword strategy is nothing new. When it comes to Shopping ads, however, the picture gets a lot murkier – Shopping is not keyword-based, and Google only offers negative keywording. Especially in large, granular accounts, the workarounds needed to execute a brand/non-brand split can be quite challenging to implement and maintain.

Is a brand/non-brand split worth it?

This benchmark report excerpt analyzes brand vs. non-brand traffic specifically in Shopping campaigns to shed some light on this topic. To produce this data, we ran a script to parse brand traffic for 750+ European accounts in eight key retail industries for the period from January 1 to June 30, 2019. The data clearly demonstrates the significance of branded traffic for merchants – both in terms of performance and budgetary planning.

Let’s take a look at:

- Overall brand/non-brand ROAS differentiation per industry

- Average brand/non-brand cost share per industry

- Average brand/non-brand differentiation for CPC and conversion rate

- Why you should care and what to do next

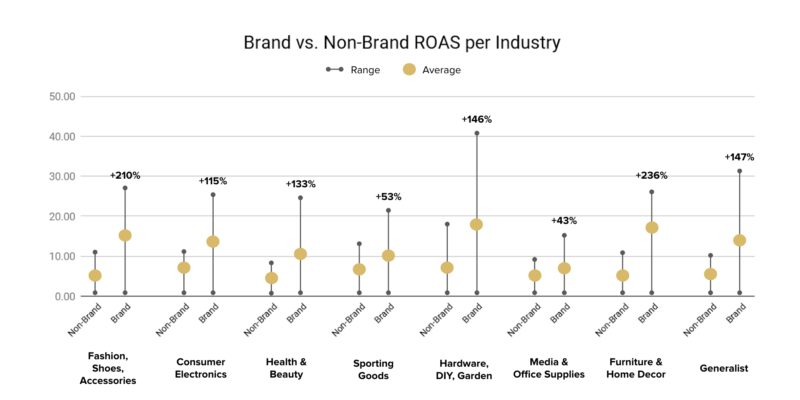

Average branded ROAS is twice as high as non-brand in most industries

Return on Ad Spend (ROAS) is a sometimes controversial but nevertheless widely accepted metric for assessing the overall performance of Shopping campaigns. (Sidenote: I recommend combining ROAS with margin information for a better assessment of profitable growth).

It might come as no surprise, but what our benchmark data proves is that branded traffic delivers a much higher ROAS than non-branded traffic. This is because Google search users who enter branded queries are typically further down the buying funnel than those who don’t: They are already brand-aware and their query implies a brand preference or interest.

Specifically, when I dug into other KPIs, I discovered that this increased ROAS performance is due to two primary factors associated with purchasing intent: on average, higher conversion rates and higher average order values (AOV). Lower average CPC also helps.

For example in Furniture & Home Decor, the whopping +236% ROAS for branded traffic is due to massively higher AOV, while in Health & Beauty, an improved conversion rate is the main driver of efficiency. Both of these influences are discussed in more detail below.

While ROAS is a popular and rather flashy metric, it alone is not sufficient to determine if advertisers in a given industry should implement a brand/non-brand split in their campaigns. The performance difference needs to be weighted by a financial metric – for example, revenue share or cost share.

Here’s a look at how much budget advertisers are spending on branded traffic in our eight sample industries.

Average branded cost share ranges from 16% to 56%

Let’s return to the above example of Furniture & Home Decor merchants, who might on average see a 236% higher ROAS for branded search terms compared to non-branded ones. It’s a mouth-watering number, but what is the impact? By looking at the average branded cost share in this industry, you can see that this performance difference impacts 20.5% of their budget, or 1 out of every 5 euros spent on Shopping ads. So yes, absolutely, that cost share seems significant and worth attention.

Even the lowest-ranking cost share – observed in the Generalist category, where we have assortments covering numerous and diverse product categories – is still affecting nearly 16% of the budget. But why, of all industries, are Generalist merchants spending the lowest percent on branded traffic? A couple of reasons jump to mind.

First, it could be that their audience makes either more generic queries with no brand term or more specific queries with product-related terms – or that Google’s algorithm matches them preferentially to more generic traffic. A second possibility could be that their data feeds are just structured or maintained differently. Our script searches the brand attribute in the merchant data feed and then cross-references the terms found there against the account’s search queries. It’s possible that for some Generalists, this data lives in different attributes, like one of the product type levels. Also, this data might tend to be missing or incomplete in their feeds, which are among the most complex to manage.

On the other side of the spectrum, Sporting Goods advertisers have a huge 55.6% cost share of branded traffic – the only industry to have a majority of costs triggered by brand terms on average. For the brands themselves, one could argue that this indicates a triumph of overall marketing efforts ranging from sponsorships to TV and display advertising yielding a strong internalized desire among shoppers to have branded fitness experiences. Yet my personal hypothesis is that it could be too much of a good thing: This heavy volume of brand traffic has among the lowest conversion rate uplifts of any industry and also relatively flat AOV between brand and non-brand. Instead of a smaller group of brand searchers who are highly motivated to buy and who generate larger basket values, this high-volume but low-productivity group could be an indicator of brand commoditization, where less intentful shoppers want a brand instead of your brand.

Brand CPCs are cheaper, but this depends heavily on industry

Whenever you see lower CPCs on better-performing traffic, it’s a great opportunity: this means you’ve got headroom for more aggressive bids and – if you’ve got the budget – you should use it. True, you might dent the ROAS slightly, but it’s a prime area for revenue growth.

This opportunity is brilliantly displayed in the Fashion industry, where branded clicks are purchased 23% cheaper than non-brand clicks on average. With 210% higher ROAS in branded fashion searches, there is plenty of room for aggression and revenue expansion. Fashion merchants advertising via Shopping ads would be well-advised to split their traffic and increase their CPCs to dominate those search results. This will ensure competitive placements above other merchants who lack the capability or the strategy. The picture is also quite rosy in the DIY & Hardware sector.

Several industries (Electronics, Health & Beauty, Sporting Goods, Furniture) exhibit poorly differentiated CPCs, with clicks running less than 10% cheaper for brand traffic. The takeaway here is not that these industries are lacking potential, but rather that you are the driver of your bidding strategy – by implementing a brand/non-brand split, you can get the control needed to address these traffic segments differently. There is simply less visible headroom here, but you’ll need to have a look at your account and your budget to decide how aggressive or defensive you want to be with CPCs, and in which segments.

Conversion rates are significantly lower for non-brand Shopping traffic

As mentioned above, inclusion of a brand term in a search query is an indicator of purchasing intent and suggests that a given shopper is likely in the mid-funnel of their buying journey. That’s why it is no surprise to see higher conversion rates for branded traffic. Two of the big winners in this regard are Health & Beauty merchants and Generalists – with Health & Beauty seeing branded conversion rates twice as high as non-brand on average. What’s noteworthy, though, is that in both of these industries we see large ranges in the data. In other words, the experience of individual merchants varies a lot, and the averaged numbers should be regarded carefully when setting expectations. I mention this in particular for this metric because conversion rate is especially dependent on merchant-specific factors and not just channel or auction factors: on-site user experience and conversion rate optimization are key challenges for any merchant.

I’d also like to call special attention to Furniture & Home Decor: The conversion rate delta of 8% is notably flat, and this retail sector also faces the flattest CPC differentiation between brand and non-brand. However, at the ROAS level, Furniture has the highest differentiation for branded traffic. So what’s going on here? On average, basket values (AOV) for branded searches are a stunning 200% higher in that industry, while all the other industries range between +7% and +23%. It’s no surprise since the price of a coffee table can range from €40 to €4000 depending on the designer – but of course, for furniture retailers focused more on commodity product lines, this trend won’t be observed.

Why these numbers matter and what you should do about it

A core limitation of Google Shopping is the lack of keywords, which limits the options available to merchants for setting strategies at different stages of the buying funnel. Worse, Shopping is not only reaching maturity in many markets, but even a saturation point – all while Amazon swallows more product searches and intrudes more in the auction environment. The channel is still growing to be sure, but many merchants are facing slowing year-over-year revenue volume and denser competition.

That’s why strategic differentiation has never been more important. To accomplish this, I would encourage every merchant with enough conversion volume to consider the following measures:

- setting bids per product

- splitting campaigns by device

- integrating margin data and other signals for profitable growth (not just ROAS)

- and of course, setting goals and bidding behaviors by query type (e.g. brand vs. non-brand)

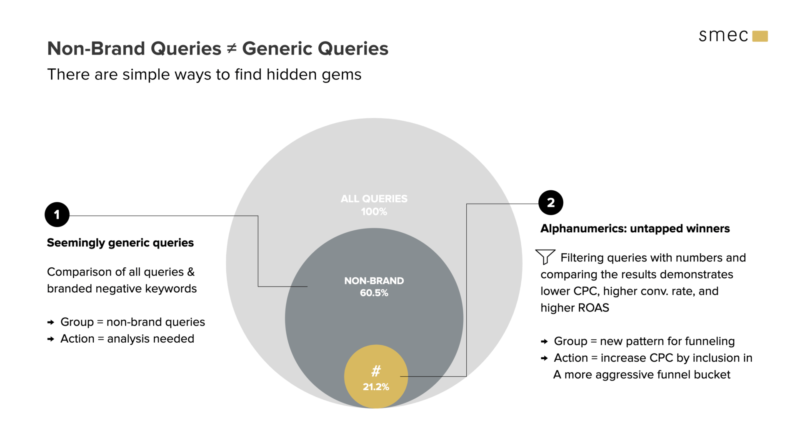

As a final note, let me mention that non-brand traffic is not the same as generic traffic. In fact, there can be highly valuable queries that feature intent signals other than brand terms – for example, product terms, color terms, alphanumeric patterns, and much more.

Connect with us to learn about the right query patterns for your account and how to automate query funneling.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

About The Author

Sponsored Content: Smarter Ecommerce (smec) Smarter Ecommerce (smec) is a SaaS+ company with an international expert team committed to delivering propulsive, best-in-class software solutions custom-tailored to Google Ads. Our landmark software solutions: Whoop!, an award-winning Google Shopping solution allows for automated campaign generation and goal-oriented bidding on the item level. AdEngine stands for data driven, scalable text ad automation– it uses business rules defined by the advertiser to communicate highly relevant information. Visit us at https://smarter-ecommerce.com/en/